A U.S. tax judge last month ruled against Michigan mega-donor Stephen Ross in a nearly 10-year-old case involving a gift to the university Ross and his partners valued at $34 million. The judge ruled the Southern California property was worth just $3.4 million

Stephen M. Ross — the billionaire owner of the Miami Dolphins NFL franchise who has given $200 million to the University of Michigan business school that bears his name — is being investigated for tax evasion by the Internal Revenue Service, according to a report in the Detroit Free Press. The case stretches back nearly ten years and involves a gift that Ross and his business partners valued at $33 million for deduction purposes, but that a U.S. tax judge last month ruled was worth only one-tenth that figure.

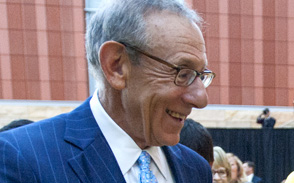

With $328 million in total gifts over the years, Ross, 77, is Michigan’s biggest donor and the second-biggest, after former New York City Mayor Michael Bloomberg, to any U.S. college or university. But a relatively small gift in 2007 caught the eye of the IRS and may cost Ross and his partners millions more in penalties.

To fulfill a $5 million pledge to build the Stephen M. Ross Academic Center for Michigan student-athletes, Ross gifted a stake in a piece of Southern California real estate that housed a data center. The university resold the property stake for nearly $2 million in cash, and Ross himself took a $5 million tax deduction. But a few months later his real estate development firm, Related Companies, claimed a $33 million deduction, and the red flags went up at the IRS. Last month after nearly a decade of legal wrangling U.S. Tax Judge James S. Halpern sided with the IRS, disallowing the entire write-off and imposing “maximum civil penalties,” according to the Freep report, “that could now cost Ross and his partners millions more.”

A HISTORY OF GIVING TO HIS ALMA MATER

Stephen M. Ross

Ross, a Detroit native who graduated from Michigan with a business degree in 1962, is worth an estimated $7.4 billion — the 186th wealthiest man in the world, according to Forbes. Michigan named its business school after Ross in 2004 after a $100 million naming gift; that money went to a new building that was completed in 2009. Four years later, Ross pledged another $200 million in a rousing ceremony that featured the school marching band playing “Hail to the Victors,” the school’s fight song, and a cascade of superlatives from university officials. The money was to be split between the business school and the university athletics program.

“Stephen Ross provided us with the resources and vision to develop our signature Ross building,” then-Ross Dean Alison Davis-Blake said after the announcement of Ross’s $200 million gift in 2013. “His most recent gift will allow us to build on that success and create a true business campus — one that features innovative design and advanced technology to empower students and faculty who share our mission to develop leaders who make a positive difference in the world.”

It might have been just another day for Ross, whose Related Companies is best known for the development of Time Warner Center in New York and the 26-acre Hudson Yards development on Manhattan’s west side.

‘I DON’T UNDERSTAND WHY SOMEONE IS NOT GOING TO JAIL’

Ross’s overvaluation of the Southern California property gifted to Michigan — inflating its value 10 times from $3.4 million to $33 million — was a “tax avoidance scheme lacking in economic substance … to the benefit of Mr. Ross and his associates at Related Companies,” according to IRS lawyers quoted in the Free Press story. The newspaper report quotes several tax law experts who say the move was totally out of bounds, and one who wonders why no one has gone to jail because of it.

“I think this transaction was grossly abusive, and the court decided that in imposing the highest non-criminal penalty that can be imposed on a taxpayer,” Brian Galle, law professor at Georgetown University Law Center, told the newspaper.

“It’s very, very rare that something is going to grow tenfold in less than a year,” said Miranda Perry Fleischer, professor of law at the University of San Diego and expert in tax policy and charitable giving. “They were trying to play games” with the gift’s valuation.

“I don’t understand why someone is not going to jail,” mused University of Florida professor Steven J. Willis, who has authored books on charities and tax law.

THE UNIVERSITY’S ROLE IS QUESTIONED

A spokeswoman for Stephen Ross said he is likely to appeal the ruling and added that it will not affect his pledges to the university. But the case has drawn new scrutiny over how Michigan, and all schools, convert gifts into cash. Meanwhile, legal storm clouds continue to swirl as Ronald Katz, Ross’s former tax accountant, and Harold Levine, a lawyer who helped close the deal involving the donation, have been charged with felony obstruction and tax evasion in a pair of cases that are unrelated to the Michigan gift case.

Michigan officials noted to the Free Press that the acceptance of the Ross gift and its resale were reviewed by lawyers and tax experts, and that the U.S. Tax Court found no fault with the university’s actions. However, IRS officials noted that Michigan violated university policies by accepting Ross’s gift without first obtaining an appraisal of its value, and by acceding to Ross’s request for an unusual two-year hold on reselling the gift. Michigan policy calls for disposing of non-cash gifts promptly, the Free Press reports.

Moreover, IRS lawyers noted, the university behaved contrary to its policies by accepting an offer to resell the property stake “from a mysterious buyer — who it turned out was the same lawyer and accountant who represented Ross and his partners in the original donation,” according to the Free Press. Nor was it university policy to resell the property stake for less than one-third the appraised value.

DON’T MISS MICHIGAN GETS ANOTHER $100 MILLION FROM ROSS and HOW CORNELL GOT $150 MILLION FROM A BILLIONAIRE